Things about Clark Wealth Partners

Table of ContentsNot known Incorrect Statements About Clark Wealth Partners All about Clark Wealth PartnersWhat Does Clark Wealth Partners Mean?Clark Wealth Partners - TruthsAll about Clark Wealth PartnersClark Wealth Partners - QuestionsGet This Report on Clark Wealth PartnersThe 5-Second Trick For Clark Wealth Partners

Common reasons to think about an economic expert are: If your monetary situation has come to be extra intricate, or you lack confidence in your money-managing abilities. Saving or navigating major life events like marital relationship, divorce, youngsters, inheritance, or task adjustment that might significantly impact your monetary circumstance. Browsing the transition from saving for retirement to protecting wealth throughout retired life and exactly how to develop a strong retirement earnings plan.New innovation has actually brought about more thorough automated monetary tools, like robo-advisors. It depends on you to explore and establish the best fit - https://yamap.com/users/4963188. Ultimately, an excellent financial expert needs to be as mindful of your investments as they are with their very own, preventing extreme costs, saving cash on tax obligations, and being as transparent as possible regarding your gains and losses

Clark Wealth Partners - Questions

Earning a compensation on item suggestions does not necessarily indicate your fee-based consultant antagonizes your ideal interests. However they may be much more inclined to advise services and products on which they make a compensation, which might or might not remain in your benefit. A fiduciary is lawfully bound to put their client's passions.

They may comply with a loosely checked "viability" standard if they're not registered fiduciaries. This common allows them to make recommendations for investments and services as long as they fit their client's objectives, danger resistance, and financial circumstance. This can equate to suggestions that will likewise gain them cash. On the various other hand, fiduciary consultants are lawfully obligated to act in their customer's best interest instead than their very own.

Not known Facts About Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving into intricate monetary subjects, clarifying lesser-known financial investment avenues, and discovering ways visitors can function the system to their benefit. As an individual money specialist in her 20s, Tessa is really knowledgeable about the influences time and uncertainty have on your financial investment decisions.

It was a targeted promotion, and it functioned. Check out more Check out much less.

10 Simple Techniques For Clark Wealth Partners

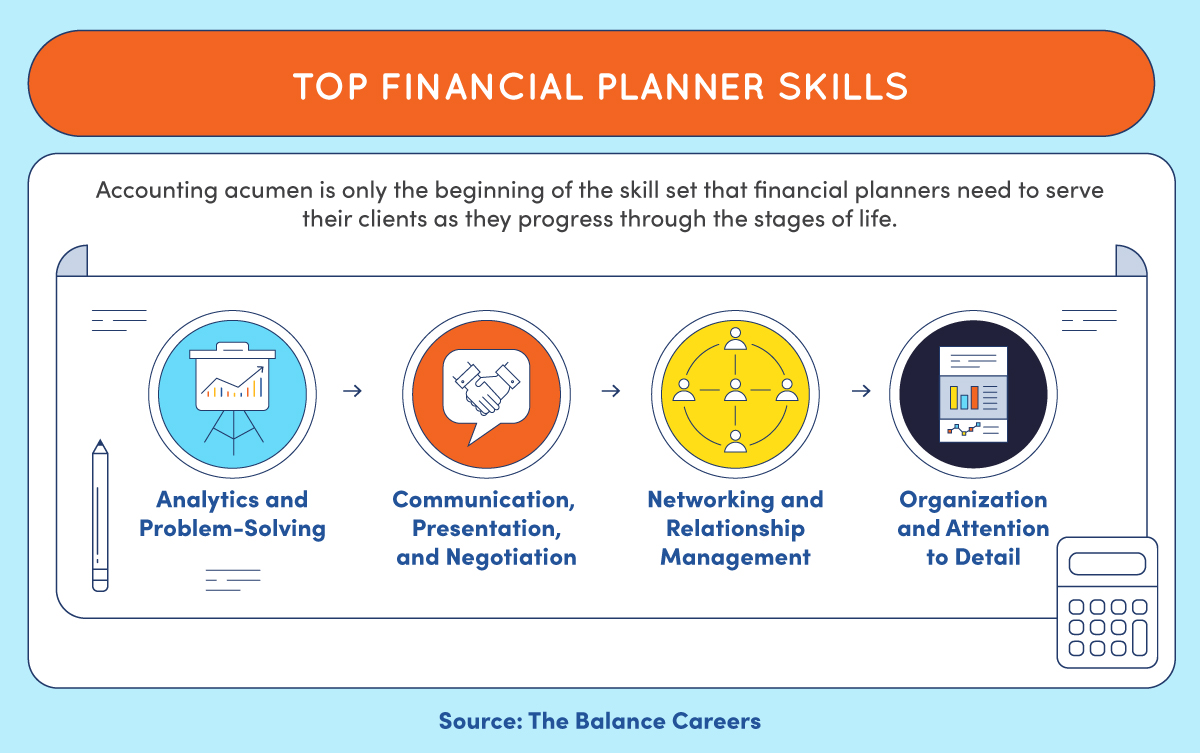

There's no solitary path to ending up being one, with some people starting in banking or insurance coverage, while others begin in accounting. 1Most monetary coordinators start with a bachelor's degree in financing, economics, bookkeeping, organization, or a relevant topic. A four-year degree supplies a solid foundation for professions in investments, budgeting, and client solutions.

The 9-Second Trick For Clark Wealth Partners

Typical examples include the FINRA Collection 7 and Series 65 tests for protections, or a state-issued insurance coverage permit for offering life or health and wellness insurance coverage. While credentials might not be legally needed for all intending roles, companies and clients frequently watch them as a benchmark of expertise. We consider optional qualifications in the following section.

Many economic coordinators have 1-3 years of experience and experience with economic items, conformity standards, and direct customer interaction. A strong instructional history is necessary, yet experience shows the ability to apply theory in real-world setups. Some programs combine both, allowing you to finish coursework while making supervised hours with teaching fellowships and practicums.

See This Report about Clark Wealth Partners

Early years can bring lengthy hours, stress to develop a customer base, and the requirement to consistently prove your expertise. Financial organizers take pleasure in the possibility to work carefully with customers, guide crucial life decisions, and often accomplish versatility in routines or self-employment.

Wide range managers can boost their revenues through compensations, property charges, and efficiency rewards. Financial managers manage a group of monetary coordinators and advisers, setting department strategy, managing compliance, budgeting, and directing inner procedures. They invested much less time on the client-facing side of the sector. Almost all economic supervisors hold a bachelor's level, and many have an MBA or similar graduate level.

Excitement About Clark Wealth Partners

Optional certifications, such as the CFP, generally call for extra coursework and screening, which can prolong the timeline by a pair of years. According to the Bureau of Labor Statistics, individual financial experts earn a mean annual annual income of $102,140, with top earners gaining over $239,000.

In other provinces, there are laws that require them to meet particular needs to utilize the economic expert or financial planner titles. official website For financial planners, there are 3 common designations: Qualified, Individual and Registered Financial Planner.

Some Known Facts About Clark Wealth Partners.

Where to locate a monetary consultant will certainly depend on the kind of recommendations you need. These establishments have team that may assist you understand and acquire particular kinds of financial investments.